Not known Factual Statements About Medciare Advantage Plan

Medicare was never intended to pay 100% of clinical costs. Medicare beneficiaries also pay a section of their clinical costs, which includes deductibles, copayments, and services not covered by Medicare.

Medical professionals and also various other providers that accept job accept accept the Medicare-approved quantity for a service. Service providers who do not approve project may bill you a 15% surcharge. You would be liable for paying the surcharge (or limiting cost) along with any copayments. You ought to constantly ask a company to accept the project.

You should take Medicare Component A when you are eligible. Some people may not want to use for Medicare Component B (Medical Insurance) when they become eligible (https://calendly.com/csmithmed22/craig-smith-insurance-medicare-medical-health-insurance-specialist?month=2022-09).

If you transform 65 as well as are covered under your functioning partner's company group health insurance, you may intend to delay enrolling in Medicare Component B. Note: Team health insurance of employers with 20 or even more employees have to provide partners of active employees the exact same wellness benefits no matter age or health standing.

The smart Trick of Medciare Advantage Plan That Nobody is Discussing

You will not be registering late, so you will not have any kind of penalty. If you select insurance coverage under the employer team health insurance plan and also are still working, Medicare will be the "second payer," which implies the company plan pays initially. If the employer group health plan does not pay all the individual's expenses, Medicare may pay the entire balance, a part, or nothing.

If you have serious pain, an injury, or an abrupt illness that you believe might create your health significant risk without instant care, you have the right to get emergency situation care. You never ever require previous authorization for emergency treatment, and also you may get emergency situation care throughout the USA (Parts B). https://yoomark.com/content/craig-smith-dedicated-helping-senior-marketplace-throughout-nation-aging-america.

You need to request this info. If you inquire on how a Medicare health insurance pays its medical professionals, then the plan should give it to you in composing (https://www.aeriagames.com/user/csmithmed22/). You likewise have a right to recognize whether your medical professional has an economic interest in a healthcare center given that it can influence the clinical suggestions she or he offers you.

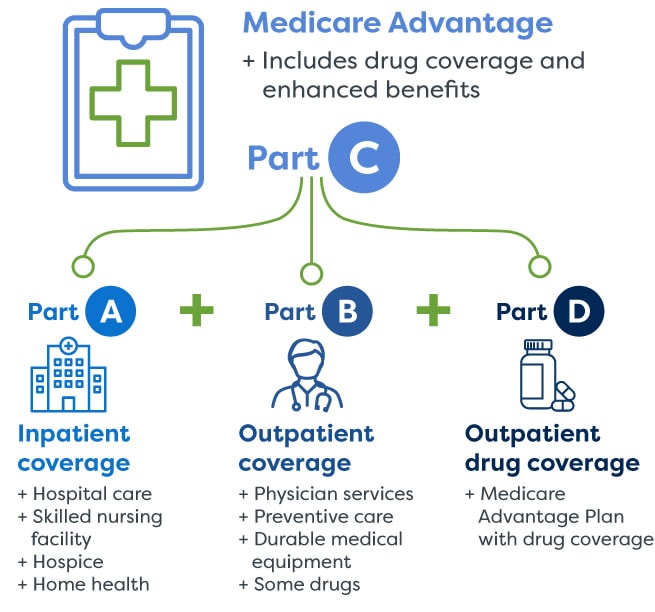

What Does Part C Mean?

The right to information about what is covered and just how much you have to pay. The right to choose a women's health specialist. The right, if you have a complex or serious clinical problem, to get a treatment plan that consists of straight accessibility to experts.

Advantage plans tend to constrain recipients to a minimal carrier network, and also protection for certain services may not be as durable as if with Original Medicare plus additional (Medigap and stand-alone Component D) protection. But Benefit strategies, including the price for Medicare Component B, also often tend to be cheaper than Initial Medicare plus a Medigap plan plus a Part D strategy.

Where these plans are readily available, it's typical to see them decrease a person's Component B Social Safety and security premium reduction by $30 to $70 monthly, although the premium discounts range from as little as 10 cents per month to as high as the full cost of the Component B premium.

Because situation, the giveback discount will be credited to the Social Security inspect to counter the amount that's subtracted for Part B. some Medicare recipients pay for their Component B coverage straight. If those beneficiaries sign up in a Benefit plan that find out has a giveback rebate, the amount of the rebate will be assessed the Component B billing that they get.

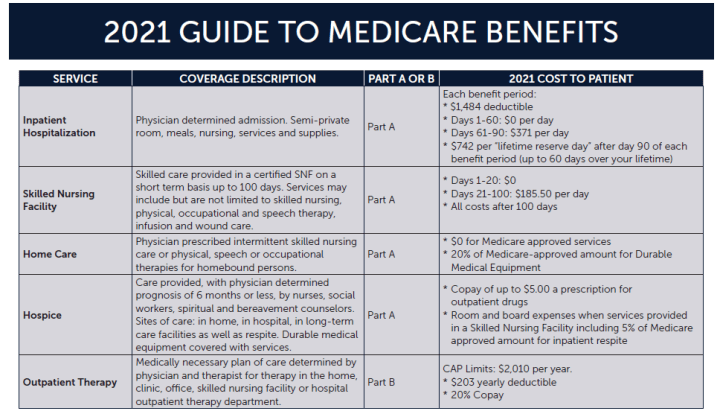

Some Known Incorrect Statements About Part A

SNPs are called for to cover prescriptions. PFFS strategies in some cases cover prescriptions, however if you have one that doesn't, you can supplement it with a Medicare Part D strategy. MSAs do not include prescription insurance coverage, but you can acquire a Part D strategy to supplement your MSA strategy. Despite the fact that Advantage enrollees have civil liberties as well as securities under Medicare guidelines, the services offered and the charges billed by exclusive insurance providers differ widely.

Benefit plans can charge monthly premiums in enhancement to the Part B premium, although 59% of 2022 Medicare Advantage intends with integrated Part D insurance coverage are "absolutely no premium" plans. This means that recipients just pay the Part B premium (and possibly less than the common amount, if they pick a strategy with the giveback discount advantage described above).

This average includes zero-premium plans as well as Medicare Advantage intends that don't include Part D protection if we only take a look at strategies that do have premiums which do consist of Component D insurance coverage, the ordinary costs is greater. Some Benefit plans have deductibles, others do not. All Medicare Benefit plans should presently limit in-network maximum out-of-pocket (not counting prescriptions) to no even more than $7,550 - Medicare supplement plan.

PFFS strategies occasionally cover prescriptions, yet if you have one that doesn't, you can supplement it with a Medicare Part D strategy. Also though Advantage enrollees have rights and defenses under Medicare standards, the services offered as well as the fees billed by exclusive insurance firms differ extensively.

Not known Incorrect Statements About Part A

Benefit plans can bill regular monthly costs along with the Part B premium, although 59% of 2022 Medicare Benefit intends with integrated Part D protection are "absolutely no costs" plans. This indicates that recipients just pay the Component B costs (and also potentially less than the common quantity, if they select a plan with the giveback rebate benefit defined over).

This average includes zero-premium plans as well as Medicare Benefit intends that don't include Component D protection if we just look at plans that do have costs which do consist of Part D protection, the ordinary costs is higher. Some Advantage plans have deductibles, others do not. All Medicare Advantage plans should currently limit in-network maximum out-of-pocket (not counting prescriptions) to no more than $7,550.

Comments on “Part C Things To Know Before You Buy”